Middle East

Palestine Investment Fund Issues Record $150 Million Bond to Boost Strategic Projects

Ramallah / PNN/

Palestine Investment Fund (PIF) announced the successful completion of the largest bond issuance in Palestine’s history, worth USD 150 million for a five-year term, with the participation of a group of local and regional banks operating in Palestine.

This issuance marks a major milestone in the Fund’s ongoing efforts to strengthen its financial position and diversify funding sources for its developmental and strategic projects. It aligns with PIF’s three-year strategy, which focuses on investing in key sectors that drive sustainable economic growth — including industrial infrastructure, energy, digital economy, healthcare, trade, and agriculture, and the promotion of national production through support for strategic industries.

Seven banks participated in the subscription: Bank of Palestine, Arab Bank, Housing Bank for Trade and Finance, Cairo Amman Bank, Al Quds Bank, Palestine Investment Bank, and the Jordan Kuwait Bank.

The issuance was executed through Ethmar Invest, which acted as the financial advisor and lead manager, while Aziz, Fouad, and Raja Shahadeh Law Office served as the PIF’s legal advisor, in coordination with the Palestine Capital Market Authority (PCMA) throughout all stages of the issuance. Arab Bank – Palestine was appointed as custodian, and payment and registration agent. The issuance was fully subscribed, reflecting the strong confidence that both the Palestinian and regional banking sectors have in the PIF— a testament to its solid financial standing, efficient management, and sustainable investment approach.

Mr. Iyad Joudeh, Chairman of the Board of Directors of the Palestine Investment Fund, stated:“This issuance represents a major economic and investment achievement that reflects the strong confidence the banking sector places in Palestine Investment Fund — both in terms of its solid financial position and its responsible and sustainable investment approach. The success of this issuance clearly demonstrates PIF’s ability to attract local and regional financing to implement its 2025–2027 strategy, which aims to invest in strategic projects that meet the current needs of our people.”

He added:“This issuance comes as part of PIF’s vision to enhance its developmental role by diversifying its financing and investment instruments, enabling it to move forward with implementing strategic projects that create job opportunities and empower the Palestinian private sector. We are proud of our partnership with the banks participating in this issuance and value their trust, which reflects our shared belief in the importance of investing in Palestine as a key driver of sustainable development.”

Joudeh concluded by emphasizing that:“PIF does not seek to compete with the private sector, but rather to empower it and strengthen its capacity by investing in sectors that require developmental intervention to achieve growth and stability. Through this issuance, we reaffirm our partnership with local banks to lead and stimulate growth in productive sectors that directly impact citizens’ lives.”

The General Assembly of bondholders held its first meeting, attended by representatives of all participating banks, during which Al Wasata Securities Company was elected as the Bond Trustee for the issuance.

Source link

#Palestine #Investment #Fund #Issues #Record #Million #Bond #Boost #Strategic #Projects

Middle East

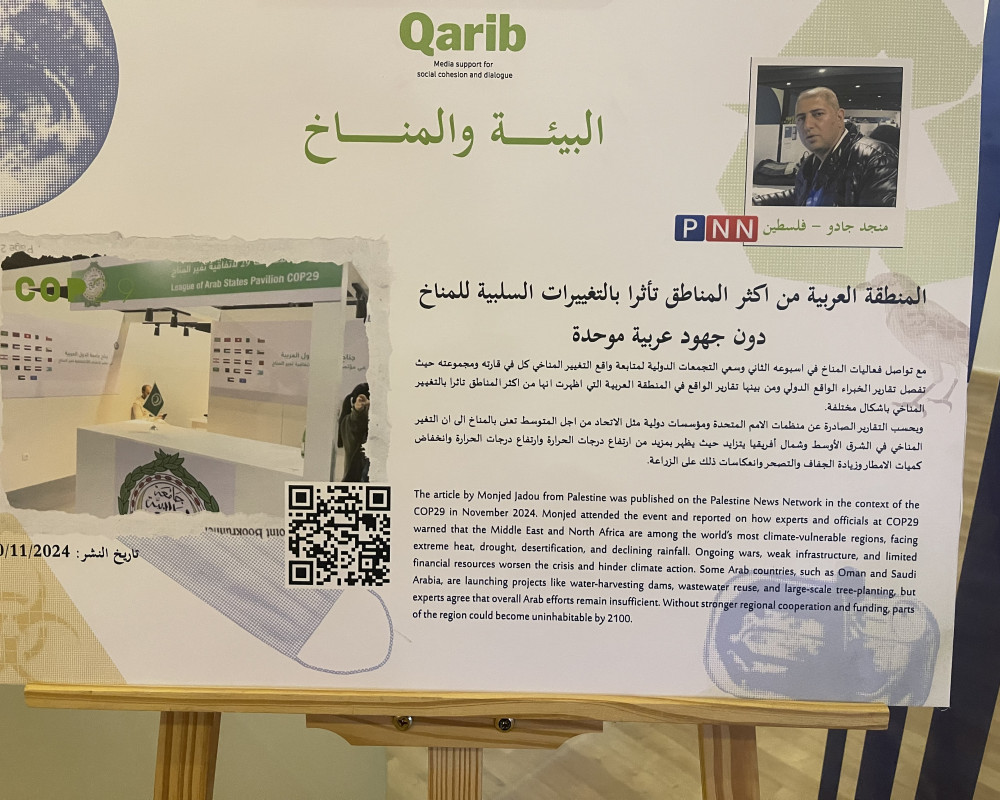

CFI Unveils Climate and Environment Media Works From Jordan, Palestine, Lebanon and Iraq

Amman / PNN /

The French media development agency CFI organised an art exhibition showcasing reports and stories produced under its environment and climate project, funded by the French Development Agency (AFD). The initiative trained journalists from four Arab countries to produce climate-related reports aimed at raising public awareness in the region about the importance of environmental protection.

The exhibition was held at CFI’s office in Amman, attended by the agency’s global director Emanuela Tolan, AFD’s regional director Yves Gescoro, QARIB programme director Henrik Erhnäs, QARIB editor-in-chief Nada Abdel Salam, representatives of various Arab media outlets, several media donors and members of the QARIB team in Jordan.

Henrik Ahrens, director of the QARIB media-development project, told PNN that CFI is hosting the exhibition to highlight climate and environmental productions created within the programme across four Arab countries. He said the goal is to inform audiences in Jordan, Palestine, Lebanon and Iraq about the importance of protecting the climate and countering negative environmental impacts.

Ahrens said the name “QARIB” was chosen because the programme seeks to bring journalists from the four countries closer together and produce stories that resonate “closely with the mind and the heart.” He added that the project is built on the idea of supporting independent media and enabling journalists from smaller outlets to participate in global climate summits, while also amplifying the voices of marginalised communities through stronger media coverage.

He noted that QARIB has allowed participating journalists to cover global discussions and negotiations on protecting the planet and preventing harmful climate change by raising public awareness. The exhibition, he added, is an opportunity to highlight what the journalists have achieved—written, visual and broadcast stories documenting climate-related issues.

Ahrens said CFI and QARIB trained groups of journalists and independent media professionals in the four countries on environmental and climate reporting. Journalists were supported to attend recent UN climate summits, where they produced in-depth coverage of global negotiations. Many have since developed the ability to create specialised environmental content that raises awareness in their communities.

The multi-year project provided training for independent media outlets in the four Arab countries, including PNN, aiming to build journalists’ skills and open opportunities for them to join international climate conferences.

Environmental journalist and trainer Suzanne Baaklini said QARIB trained journalists on key issues discussed at climate summits, including climate-finance negotiations, the responsibilities of major industrial countries, and the measures needed to mitigate negative environmental impacts. She said participants have since produced strong climate and environment reporting both during summits and in their home countries.

Journalists benefiting from the programme expressed their gratitude during the exhibition, stressing that the experience opened new horizons they hope to build upon.

Monjed Jadou, editor-in-chief of Palestine News Network (PNN) and founder of the “Arab Journalists for Climate” platform, said the network was proud to be part of the project. He thanked CFI and AFD for allowing PNN to cover the climate summits for several years, helping deepen regional climate reporting and raise awareness among Palestinian and Arab audiences. He noted that international reports indicate the Mediterranean Basin is among the regions most vulnerable to climate impacts and could become increasingly uninhabitable in the future.

Jadou highlighted the Arab Journalists for Climate initiative, which participating journalists agreed to establish during the climate summit in Azerbaijan.

The volunteer-run platform covers Arab climate and environmental issues and currently seeks support to expand its work. He expressed hope that CFI would be one of its first supporters.

Lebanese journalist and climate-film producer Karam Mandar said QARIB allowed him to closely follow developments at the climate summits. After attending the past three conferences, he produced several short films on climate issues relevant to Lebanon and the wider Arab region. He expressed hope that independent media would continue to thrive in the four countries, as it plays a crucial role in amplifying public concerns, including environmental protection and climate challenges.

Mounia Dweik, director of the “Roya Palestine” channel, said the channel has recently developed its coverage of war-related environmental impacts, producing reports on the consequences of conflict on climate, land degradation, water pollution and soil contamination. She stressed the importance of addressing these issues.

Dweik added that the channel also prepared extensive climate-summit coverage, highlighting Palestinian issues throughout the events.

Jordanian journalist Abdulrahman Makawi, director of Jordan’s Aramram News, said the QARIB climate and environment project provided him with essential exposure to climate and water issues, which are of major concern to the Jordanian public. He said the outlet has since produced numerous specialised environmental reports. Makawi thanked CFI and the QARIB team for supporting young Jordanian journalists and expressed hope for more such opportunities.

The photographs showcased at the CFI exhibition—drawn from the climate reports produced through the programme—illustrated success stories and underscored the need for more support to strengthen environmental protection efforts and raise climate awareness across Arab societies, which remain among the regions most affected by climate change.

Source link

#CFI #Unveils #Climate #Environment #Media #Works #Jordan #Palestine #Lebanon #Iraq

Middle East

In Gaza Beauty expert’s lost dream

Gaza / PNN/ Iman Helas

For 13 years, Zeynep Hassouna patiently built a reputation as one of Gaza City’s most skilled beauty experts. In one single morning, Zeynep’s world and dreams shrank to a tent.

Today, Zeynep, 36, lives in a crowded tent in al-Yarmouk playground with her family and her brother’s. Piles of rubbish sit in front of the tent, occasionally emitting a foul stench and attracting flies.

“Before the war, I used to live as a queen — my business was excellent.” Zeynep managed to achieve remarkable success despite Israel’s 18-year blockade.

Women from the southern Strip traveled hours to her salon, Zain Salon, to have their hair or makeup fixed.

Her business was the source of income for her family and her brother’s as well.

In the first hours of war, Zeynep and her staff waited for clients, but none came. “In the [salon’s] street, hardly one man would pass every one hour or two,” Zeynep described the Sahaba Street, one of the most lively streets in Gaza City.

Feeling an upcoming calamity, Zeynep locked the salon by noon on October 7. She called the property owner to end the salon’s rental contract. “For a while,” she said, but that “while” extended for two years and is still ongoing.

The successful beauty expert became an evacuee. The Israeli army forced her to flee with her family to al-Shifa hospital, to al-Zarqaa neighborhood, to a tent in al-Yarmouk playground, to a tent in the southern Gaza Strip, and to a tent in al-Yarmouk playground once again.

Beauty for the Bereaved

Even with the salon closed, Zeynep tried to resume her work in any way. She called her regular clients, offering beauty services, but all said they could not. They were mourning one or more family members.

“Many of my clients were martyred. One woman was a regular client of mine with her five daughters — all of them were martyred. Some lost their husbands, and some lost their children.”

For the first 14 months of war, Zeynep did not gain one shekel.

According to Zeynep, one year and nearly two months into the war, people began to seek beauty experts. Her phone started ringing again, with women asking to do bridal makeup.

During that period, all of the brides Zeynep attended had experienced personal tragedy.

“I fixed makeup for a bride who lost both parents, a bride who lost her mother-in-law, and a bride who lost her brothers-in-law.”

“I also fixed up makeup for many war widows who were to marry their late husband’s brothers,” she added,

The makeup would be very simple, “just to get through the celebration.” During that period, celebrations were a way to cling to normalcy and tradition rather than a display of joy. Mourning families wanted to reclaim the means to smile and ensured to honor their martyred loved ones in the celebrations.

Zeynep’s work remained limited, not bringing in enough income to cover her family’s basic needs in the city with the [highest cost of living.

What if

“If I were able to work properly and bring any food, my nephew wouldn’t have eaten feces from the ground.”

One morning during the harsh famine, Zeynep took her six-year-old nephew to a school to register for humanitarian aid during the famine. She left him at the door for just a moment.

When she returned, she found him sitting in the school bathroom, a tiny piece of bread in his small hand, pressing it into the dirt.

Zeynep tortures herself with the thought that her inability to work was the reason behind all of her family’s and her brother’s family problems.

Unlike many Gazans, Zeynep did not lose her home due to bombardment. Before that, the war deprived her of living happily in it, forcing her to be displaced repeatedly.

Eventually, her family was kicked out of the home, and did not find any place other than a simple tent sheltering them. It had taken Zeynep and her brother nine years to finally find an apartment spacious enough for both families. They lived in it for six years, where Zeynep’s nephews knew no other home. Losing it meant losing the last piece of normal life they could offer to the children.

“If I were working, we would not have been here in the tent. My mother would not have been in this state.”

Zeynep’s mother, 72, became paralyzed due to the harsh famine in northern Gaza. In the first days of famine, Zeynep’s mother began to see hallucinations suddenly.

“She was scolding us, telling unreal things, like why her brother was martyred and no one told her. She once hallucinated a bomb directed at her. I assumed it was a side effect of the high blood pressure drug. But when I took her to the hospital, she was diagnosed with a stroke in the brain.”

As the famine and the war intensified, Zeynep’s mother was diagnosed with three more strokes.

“My mother needs diapers because of her condition right now. But I can’t even afford to buy them.”

Unreached dream of beauty tent

Zeynep hoped that the ceasefire would allow her to work as before, to continue pursuing the dream she had left, and consequently to enhance her family’s and her brother’s lives. But the ceasefire fulfilled none of those hopes.

“Even after the ceasefire, the raw materials needed for my work were not available. For example, if a client asks me to dye her hair, I have to provide hair bleach powder, which is barely available in Gaza.”

Zeynep occasionally wanders the city searching for raw materials. If found, prices are often about 15 times their usual price. “The problem is I can’t buy and store them — these products spoil quickly, and I don’t have a salon that guarantees enough clients to use them all.”

This reality makes her consider opening a beauty tent to widen the circle of her clients.

“I am going to buy a tent and set it in the playground. One mirror, one chair — and I’ll resume work. I will start by offering the simplest services: cutting hair, removing facial hair, or shaping eyebrows.”

“I wish I could reopen my past salon, but I no longer have the capacity to do that.”

This expert’s current aim is a bitter contrast to her former ambition. Before, she put great effort into saving money to buy advanced machines that are rarely found in Gaza, dreaming of having the Strip’s only salon of its kind.

Normally, a beauty salon would have air conditioners to protect makeup from melting in the heat; the fabric of the tent traps the heat instead. On rainy days, Zeynep has to stay cautious, ensuring the rain does not seep into the tent, ruining everything.

She will not be able to leave the tent even during the night, fearing theft, especially in the state of [chaos](https://www.theguardian.com/world/2025/may/07/desperate-traumatised-people-gaza-faces-wave-of-looting-theft-and-violence) that overwhelmed Gaza following the war.

But even this simple yet challenging dream is unreachable for Zeynep. She needs to buy another tent to pursue her dreams, but her mother’s medical care consumes every shekel she spares.

Zeynep knows that she can no longer restore what the war deprived her of. Her wide salon, her mother’s health, her nephews’ memories of stability — all belong to the past now.

Despite this, Zeynep still wanders the Strip, searching for raw materials, and walks long distances to her clients’ houses, with her dream of owning the Strip’s only salon of its kind in her mind

Source link

#Gaza #Beauty #experts #lost #dream

Middle East

Foreign Diplomats Tour Bethlehem, Voice Support for Reviving Palestine’s Tourism Sector

BETHLEHEM, West Bank / PNN /

The Palestinian Ministry of Tourism and Antiquities organised a tour on Tuesday in Bethlehem for members of the diplomatic corps accredited to the State of Palestine, aiming to brief them on conditions in the governorate amid Israeli occupation measures and on Palestinian efforts to revive and develop the tourism sector as a key tool for promoting Palestinian culture and strengthening the local economy in Bethlehem and across Palestine.

Several foreign diplomats expressed support for the Palestinian people, stressing the importance of enhancing cooperation through the development and expansion of tourism programmes. They also encouraged their citizens to visit Palestine — including Bethlehem and its historic sites — describing the city as calm and fully prepared to receive visitors.

The tour, which included dozens of diplomats and representatives of international institutions, featured stops at the Walled-Off Hotel, the Palestinian Heritage Museum, the Church of the Nativity, Star Street and the Saint Elias Hotel. Minister of Tourism and Antiquities Hani Hayek, Bethlehem Governor Mohammad Taha Abu Alia, and Bethlehem Mayor Maher Qanawati accompanied the delegation, briefing them on the ministry’s and private sector’s efforts to attract tourism groups from around the world and to strengthen direct cooperation between Palestinian tourism institutions and their counterparts abroad.

Palestinian Tourism Minister Hayek highlighted the ministry’s international outreach efforts to reaffirm that Palestine is ready to welcome visitors from all countries. “Bethlehem in particular, and Palestine in general, are safe and fully prepared to receive tourists from across the world,” he said.

Hayek said the ministry is working to restore tourism activity to its pre-crisis levels, noting that Palestine remains a beacon for travellers from diverse backgrounds. “By visiting Palestine, tourists can learn the truth about the Palestinian people — a hospitable nation rooted in this land and in its history,” he added.

He also briefed diplomats on the importance of the tourism sector to Palestine, describing it as one of the pillars of the national economy, a major source of national income, and a primary livelihood for many Palestinian families, as well as Palestine’s gateway to the world.

For his part, Bethlehem Governor Mohammad Taha Abu Alia underscored the significance of the tourism sector as an essential platform for presenting the history and identity of the Palestinian people to the world.

He praised the Ministry of Tourism and Antiquities for enhancing Palestine’s presence on the global tourism map, saying the sector plays a vital role in conveying the Palestinian narrative and showcasing success stories that reflect the resilience of Palestinians and their attachment to their land and heritage.

Bethlehem Mayor Maher Qanawati reaffirmed the city’s readiness to welcome tourists from all corners of the world, noting that the people of Bethlehem warmly receive visitors and tourism groups. He thanked the Ministry of Tourism and Antiquities for its efforts to promote the Palestinian tourism sector internationally.

Source link

#Foreign #Diplomats #Tour #Bethlehem #Voice #Support #Reviving #Palestines #Tourism #Sector

-

United States1 day ago

United States1 day agoIn an accelerated procedure and without modifications, the Senate approves the minutes of the Water Law

-

United Kingdom1 day ago

United Kingdom1 day agoEdinburgh Airport flights grounded as travelers see plans scuppered due to IT glitches

-

Ireland1 day ago

Ireland1 day agoIrish peacekeepers “realized” after coming under fire in Lebanon

-

United States1 day ago

United States1 day agoLeBron James’ 19-year double-digit scoring streak ends – VIDEO

-

Ireland1 day ago

Ireland1 day agoWatchdog brings forward deadline for car finance companies to deal with complaints – The Irish News

-

United Kingdom1 day ago

United Kingdom1 day agoA region of the UK where house prices are soaring – while prices stagnate elsewhere

-

Middle East7 hours ago

Middle East7 hours agoCFI Unveils Climate and Environment Media Works From Jordan, Palestine, Lebanon and Iraq

-

News & Knowledge / Facts1 day ago

News & Knowledge / Facts1 day ago3.3 million retirement savers facing salary sacrifice changes