News & Knowledge / Facts

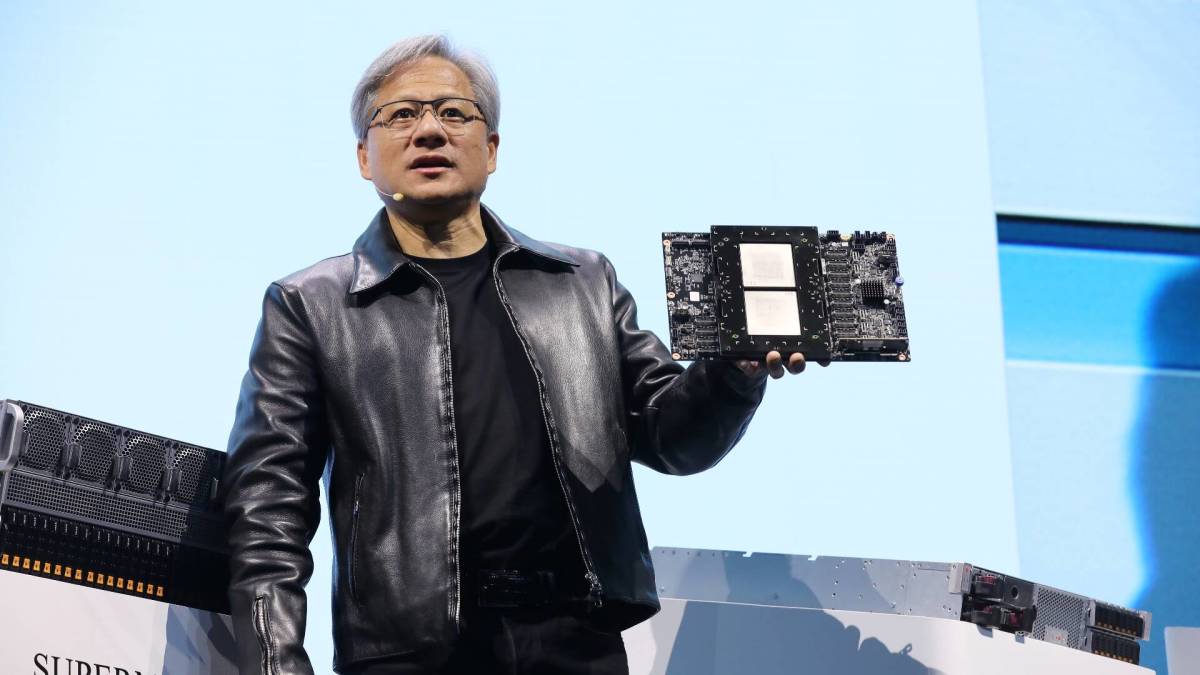

Nvidia makes its biggest purchase of all time today #Nvidia #biggest #purchase #time #today

According to CNBC, Nvidia agreed to pay about $20 billion in cash for Groq, a specialist in AI accelerator chips used to power inference, the stage where trained AI models actually answer questions, generate text or drive applications in real time. Alex Davis, CEO of investment firm Disruptive, which led Groq’s latest funding round, told CNBC the deal closed quickly, months after Groq raised $750 million at a valuation of around $6.9 billion.

Disruptive has invested more than $500 million in Groq since its founding in 2016, and Groq is now expected to notify investors of the Nvidia acquisition as soon as details are finalized. The acquisition would include Groq’s core chip design and related assets, while excluding the company’s early-stage Groq Cloud business, which provided developers with access to its API-based hardware.

On Nvidia’s side, the financial capacity is obvious. The chip giant ended October with about $60.6 billion in cash and near-term investments, up sharply from about $13.3 billion at the start of 2023, fueled by an explosion in demand for its AI GPUs. An all-cash structure means no dilution for existing shareholders, but it also speaks to Nvidia’s belief that securing Groq’s technology will pay off in the long term, even at a high premium.

Why this is Nvidia’s biggest acquisition ever

This deal with Groq instantly becomes Nvidia’s largest acquisition by total value, surpassing its $6.9 billion purchase of Israeli networking company Mellanox in 2019. Mellanox gave Nvidia high-speed networking and interconnection technology that has become crucial for building large AI clusters, effectively transforming Nvidia from a GPU supplier to a full-stack data center platform provider.

Shutter

Nvidia has already tried to go even further. In 2020, it announced plans to buy British chip designer Arm from SoftBank for a combination of cash and stock worth up to $40 billion, a move that would have reshaped the global semiconductor landscape. That deal collapsed under regulatory pressure in 2022, after authorities in the United Kingdom, European Union and United States expressed concerns that Nvidia could gain too much influence over the licensing of Arm’s processor designs.

More from Nvidia:

- Nvidia’s Chinese chip problem isn’t what most investors think

- Jim Cramer delivers brutal 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes surprise call on Nvidia-backed stocks

The Groq acquisition is smaller in dollar terms than Arm’s failed attempt, but it’s still huge for a single technology target. By spending nearly three times Groq’s latest valuation, Nvidia signals that inference hardware is not just a sideline business, but a critical pillar of AI’s next revenue growth.

The race for AI inference heats up

The AI chip market falls into two broad categories: training and inference. Training is where massive models are built, often using thousands of Nvidia GPUs in data centers run by companies like Microsoft, Amazon, and Google. Inference is where these models are actually used for search, chatbots, co-pilots, AI video, and any application that requires rapid, repeated responses at scale.

Groq has positioned itself as a specialist in pure inference. Analyst-driven coverage from outlets like AInvest claims that Groq’s hardware can deliver extremely low latency performance, with some marketing reporting speeds up to twice that of competing systems on certain workloads while maintaining accuracy. This promise of performance, combined with a simplified programming model, made Groq an attractive option for developers who wanted something faster and more predictable than general-purpose GPUs for production workloads.

Related: Nvidia’s Controversial Rival May Finally Go Public

Regulatory control and antitrust risks

Because Nvidia is already at the center of the AI hardware world, any major deal it strikes will raise eyebrows in Washington, Brussels, London and Beijing. Reuters notes that regulators have been closely monitoring Nvidia’s growing role in AI computing, and that the Groq deal is expected to face antitrust scrutiny in multiple jurisdictions.

Key questions will likely center around whether the Groq acquisition significantly reduces competition in AI inference hardware and whether Nvidia could use control over Groq’s chips to disadvantage rivals or exclude alternatives for cloud providers and enterprises. Nvidia has argued in past transactions that integrating acquired technologies into its stack benefits customers by improving performance and innovation, but regulators have become more sensitive to vertical consolidation of critical digital infrastructure.

For investors, the risk is not only that regulators block the transaction (as happened with Arm), but also that they impose corrective measures. These could include requirements for licensing, interoperability or access to Groq’s technology for third parties on fair terms, which could reduce some of the strategic advantages that Nvidia pays for.

What this means for investors and everyday savers

If you own Nvidia, this acquisition tells you a few important things about where the company is taking the puck.

- First, Nvidia expects demand for AI to shift from a development phase, where companies scramble to train models, to a deployment phase where inference workloads explode across all industries and devices. Owning specialized inference technology becomes a way to capture this second wave of spending and prevent customers from switching to competitors that offer cheaper or more efficient hardware for production use.

- Second, Nvidia relies on an ecosystem strategy rather than a product-only strategy. By combining GPUs, networking (from Mellanox), software (CUDA and related libraries), and specialized accelerators (chips from Groq), Nvidia can offer end-to-end solutions that are harder for competitors like AMD, Intel, or custom chips from cloud providers to replace. To the average investor, this looks like a divide, but it also concentrates risk in a single company.

- Third, chip-level consolidation may eventually appear in your portfolio. If Nvidia can use Groq’s technology to make inference cheaper and more efficient, it could lower the cost for startups and companies providing AI services, which in turn could mean more competition and better tools for consumers and small investors. But if fewer independent chip options lead to higher prices or tighter reliance on vendors, cloud and software providers could pass on higher infrastructure costs, and some innovations could be sidelined.

For long-term savers, the practical takeaway is that AI infrastructure is becoming a central part of the market story, not just a technological subplot. Nvidia’s willingness to spend $20 billion in cash on Groq reinforces the idea that controlling compute is like owning the toll road on the AI highway.

Related: Nvidia’s $4 Trillion Moment Came With a Quiet Warning Sign

Source link

#Nvidia #biggest #purchase #time #today

News & Knowledge / Facts

MARKETS EUROPE/DAX is up slightly at target level #MARKETS #EUROPEDAX #slightly #target #level

DJ MARKETS EUROPA/DAX is up slightly from the target level

DOW JONES–European stock markets are higher Tuesday afternoon. There is little news and most investors are no longer active as the start of the year approaches. We cannot exclude the so-called “window dressing” of individual stocks, i.e. the targeted maintenance of prices in the portfolios of institutional investors. On some exchanges, trading is shortened only on Tuesdays. Trading in Germany and Austria ends at 2 p.m. THIS. While today is the last trading day of the year on some exchanges, shortened listings will take place on Wednesday in Lisbon, London, Madrid and Paris.

The DAX gained 0.5 percent to 24,476 points; the index is up 22 percent since the start of the year. The DAX can look back on an excellent year overall. “A closer look, however, shows that only the first half of the year was excellent for the DAX. The second half of the year was more of a sideways trend,” explains QC Partners. The MDAX is once again lagging and is up 19 percent year to date. The TecDAX has a meager yield of 5 percent. This continues the pattern of German blue-chip companies performing better in their international operations than German mid-sized companies. Whether this will change with Germany’s billion-dollar investment program remains to be seen.

The Euro-Stoxx-50 rose by 0.6 percent to 5,789 points. The majority of the year’s best-performing countries come from the South, where European economic growth was based last year. The Spanish stock market rose by 48 percent, while in Athens the index even rose by 50 percent.

On the foreign exchange market, the euro changes little, at $1.1769; During the year, the greenback lost a lot of value. This is unlikely to make it easier for European companies to sell more expensive products around the world due to the strength of the euro next year. Yields on the bond markets are up slightly. After the liquidation of the day before, precious metals are recovering. The price of gold rose 1.2 percent to $4,385, silver rose 3.8 percent to $74.90. Not surprisingly, European mining stocks were one of the day’s winners, rising 1.6 percent. Shares of silver producer Fresnillo rose 5.5 percent.

The geopolitical situation remains tense. US President Donald Trump has threatened Iran with a military strike if the country resumes its nuclear program. Meanwhile, Hamas was threatened with serious consequences if the terrorist organization did not lay down its arms. Finally, China is organizing one of the largest military exercises in recent years off the coast of Taiwan. This is likely a reaction to the recent announcement of US arms deliveries to the island nation.

Additionally, the United States recently carried out an attack on a port area in Venezuela where US President Trump said drugs were being loaded onto boats and smuggled across international waters, saying a “big explosion” had occurred. Oil prices are barely reacting to this news. Brent is up 0.4 percent.

Defense stocks are recovering after the selling pressures of the day before. There is still no sign of progress in peace or ceasefire negotiations in Ukraine. Rheinmetall gained 2.1 percent, Renk 2.5 percent and Hensoldt 0.9 percent.

Meanwhile, bank stocks continue to run. The sector can look forward to a good year in 2025 thanks to the rise in yields on the bond markets. Deutsche Bank gains 1.5 percent and Commerzbank 2.0 percent.

Chipmaker Infineon’s sales growth (+1.8%) is down, with only one sector seeing strong growth: semiconductors to power AI data centers. “We are seeing a strong increase in demand and many indicators suggest that this will continue in the coming years,” CEO Jochen Hanebeck told Handelsblatt. “We currently cannot deliver as much as customers order.”

=== INDEX zuletzt +/- % absolut +/- % YTD Euro-Stoxx-50 5.788,57 +0,6% 36,86 +17,4% Stoxx-50 4.918,84 +0,5% 25,52 +13,6% DAX 24.476,16 +0,5% 125,04 +22,3% MDAX 30.548,50 +0,3% 95,97 +18,4% TecDAX 3.613,61 +0,4% 13,79 +5,0% SDAX 17.094,60 +0,5% 78,05 +22,6% CAC 8.141,91 +0,4% 29,89 +9,8% SMI 13.259,65 +0,1% 19,06 +14,2% ATX 5.304,29 +1,1% 56,33 +43,2% DEVISEN zuletzt +/- % 0:00 Mo, 18:00 % YTD EUR/USD 1,1769 +0,0% 1,1767 1,1756 +13,7% EUR/JPY 183,56 -0,1% 183,67 183,59 +13,1% EUR/CHF 0,9286 -0,1% 0,9291 0,9287 -1,0% EUR/GBP 0,8715 -0,0% 0,8716 0,8712 +5,4% USD/JPY 155,94 -0,1% 156,03 156,12 -0,5% GBP/USD 1,3505 +0,0% 1,3502 1,3494 +7,9% USD/CNY 7,0292 -0,0% 7,0312 7,0324 -2,3% USD/CNH 6,9881 -0,2% 6,9987 7,0001 -4,5% AUS/USD 0,6701 +0,1% 0,6693 0,6690 +8,4% Bitcoin/USD 87.770,40 +0,6% 87.232,35 87.544,55 -7,3% ROHÖL zuletzt VT-Settlem. +/- % +/- USD % YTD WTI/Nymex 58,29 58,08 +0,4% 0,21 -20,9% Brent/ICE 62,12 61,94 +0,3% 0,18 -19,4% METALLE zuletzt Vortag +/- % +/- USD % YTD Gold 4.384,52 4.330,40 +1,2% 54,12 +72,8% Silber 74,90 72,18 +3,8% 2,73 +173,6% Platin 1.854,76 1.791,70 +3,5% 63,06 +137,7% Kupfer 5,49 5,49 0% 0,00 +33,6% YTD bezogen auf Schlussstand des Vortags (Angaben ohne Gewähr) ===

Contact the author: maerkte.de@dowjones.com

DJG/thl/ros

(END) Dow Jones Newswires

December 30, 2025 7:01 a.m. ET (12:01 p.m. GMT)

Copyright (c) 2025 Dow Jones & Company, Inc.

Source link

#MARKETS #EUROPEDAX #slightly #target #level

News & Knowledge / Facts

Nuggets’ Nikola Jokic prepares for MRI after injuring knee in Miami #Nuggets #Nikola #Jokic #prepares #MRI #injuring #knee #Miami

MIAMI — Nuggets star Nikola Jokic limped off the court at halftime of Denver’s 147-123 loss to the Miami Heat on Monday night after injuring his left knee about three seconds before intermission.

He was not on the field in the second half and will have an MRI on Tuesday.

“Immediately he knew something was wrong,” Nuggets coach David Adelman said after the game. “Hey, that’s part of the NBA. Anyone who gets hurt in this game, it’s a little heartbreaking, especially someone as special as him. We’ll know more tomorrow. We’ll move forward as a team. Obviously, right now, I’m more concerned about him as a person and the disappointment of going through something like this.”

Jokic was alone under the basket and appeared to step forward to help Denver’s Spencer Jones defend a drive by Miami’s Jaime Jaquez Jr. as time was about to expire in the second quarter. While reversing, Jones stepped on Jokic’s left foot and it appeared the center’s knee bent a bit.

Jokic collapsed on the court, grabbing his knee. He was helped to his feet, then made his way to the locker room under his own power but with a pronounced limp. He was evaluated by doctors Monday night before leaving the arena, and the Nuggets were scheduled to fly to Toronto on Tuesday for a game against the Raptors on Wednesday.

“It’s just part of this process,” Adelman said. “You don’t get definitive answers right after these things happen. I know he’s an extremely special player that people want updates on immediately; that makes perfect sense to me. But we will follow the process properly, for him and for our team.”

The Nuggets have faced major injury issues this season and were playing Monday without three potential contenders: Christian Braun (left ankle sprain), Aaron Gordon (right hamstring sprain) and Cameron Johnson (right knee injury management).

Denver has managed to fight its way through these injuries – thanks in large part to Jokic.

“The things he’s doing this year,” Heat coach Erik Spoelstra said before Monday’s game, “are really remarkable.”

Jokic had 21 points, 8 assists and 5 rebounds in the first half on Monday. If he sits out for any length of time, it will be a major blow to Denver and, in some ways, the entire NBA, given that he is one of the game’s superstars. Even a month’s absence would mean about 16 games, which could have a serious impact on Denver’s standing in a loaded Western Conference.

“Tonight my mind is going to wander,” Adelman said. “And there will be questions about what we should do in the future if he is out for a while or a long period of time.”

Jokic is a three-time MVP and was certainly early in the MVP conversation this season, having started Monday averaging 29.9 points, 12.4 rebounds and 11.1 assists – on track to average a triple-double for the second straight campaign.

“He’s not only a big part of what we do, but almost everything we do,” Nuggets guard Jamal Murray said. “We just want to see him healthy, and everyone here is ready to step up.”

Jokic has also been remarkably durable. He has missed 36 games over the past five seasons; the Nuggets went 13-23 during those absences. He played in all 32 games for Denver this season.

“I hope for the best,” Adelman said.

The Associated Press contributed to this report.

Source link

#Nuggets #Nikola #Jokic #prepares #MRI #injuring #knee #Miami

News & Knowledge / Facts

Russia accuses Ukraine of attacking Putin’s residence with drones; Kyiv denies allegations #Russia #accuses #Ukraine #attacking #Putins #residence #drones #Kyiv #denies #allegations

The conflict, which began with Russia’s invasion of Ukraine in February 2022.

Russia on Monday accused Ukraine of launching a large-scale drone attack on one of President Vladimir Putin’s residences in the Novgorod region, a claim kyiv dismissed as a “fabrication” intended to derail ongoing peace talks.

Russian Foreign Minister Sergei Lavrov said Ukraine deployed 91 long-range unmanned aerial vehicles (UAVs) overnight from Sunday to Monday. He claimed that all drones were intercepted and destroyed by Russian air defenses and that there were no casualties or damage. Lavrov called Ukraine’s actions “state terrorism” and warned that Russia would reconsider its negotiating position in the U.S.-led peace process.

Ukraine has strongly denied these allegations. President Volodymyr Zelensky called the claims “typical Russian lies” designed to justify further attacks on Ukraine and undermine peace efforts with the United States. “It is essential that the world does not remain silent now,” Zelensky said on X, calling for continued international support for the negotiations.

The accusation comes shortly after Zelensky met with US President Donald Trump in Florida to discuss a revised peace plan. Ukraine says it has accepted 90% of the US proposal, including post-war security guarantees, although territorial disputes remain unresolved.

Zelensky rejected the request

Speaking to Fox News, Zelensky said that while there is a “possibility of ending this war” by 2026, Ukraine still counts on support from the United States. He also expressed skepticism about Putin’s desire to seek peace.

The conflict, which began with Russia’s invasion of Ukraine in February 2022, has left much of the eastern Donbass region disputed. Russia controls around 75% of Donetsk and 99% of Luhansk, while Ukraine continues to resist Moscow’s advances.

As tensions rise, international attention is now focused on whether alleged attacks like the one on Putin’s residence further complicate the fragile peace process.

Source link

#Russia #accuses #Ukraine #attacking #Putins #residence #drones #Kyiv #denies #allegations

-

News & Knowledge / Facts2 days ago

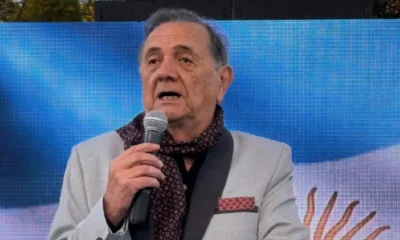

News & Knowledge / Facts2 days agoTango is sad: singer “Chiqui” Pereyra has died #Tango #sad #singer #Chiqui #Pereyra #died

-

News & Knowledge / Facts3 days ago

News & Knowledge / Facts3 days agoRayan Cherki scores crucial late victory for Manchester City at Nottingham Forest #Rayan #Cherki #scores #crucial #late #victory #Manchester #City #Nottingham #Forest

-

Ireland2 days ago

Ireland2 days agoRIP: Christmas tragedy as two elderly men die following fire at rural Sligo house #RIP #Christmas #tragedy #elderly #men #die #fire #rural #Sligo #house

-

News & Knowledge / Facts4 days ago

News & Knowledge / Facts4 days agoChina sanctions 30 US companies and individuals for arms sales to Taiwan | Gun News #China #sanctions #companies #individuals #arms #sales #Taiwan #Gun #News

-

News & Knowledge / Facts3 days ago

News & Knowledge / Facts3 days agoRussian drones and missiles bomb Ukraine ahead of Zelensky-Trump meeting #Russian #drones #missiles #bomb #Ukraine #ahead #ZelenskyTrump #meeting

-

Ireland4 days ago

Ireland4 days agoRaw revelations from within the royal family in the 1995 State Papers #Raw #revelations #royal #family #State #Papers

-

News & Knowledge / Facts4 days ago

News & Knowledge / Facts4 days agoCAN: Salah’s penalty sinks South Africa #Salahs #penalty #sinks #South #Africa

-

News & Knowledge / Facts3 days ago

News & Knowledge / Facts3 days agoRussia targets kyiv with missiles ahead of Ukraine-US meeting #Russia #targets #kyiv #missiles #ahead #UkraineUS #meeting