News & Knowledge / Facts

Trend reversal now?! Is the big breakthrough imminent? #Trend #reversal #big #breakthrough #imminent

© Photo: by Nadine1605 on Pixabay

The Ludwigshafen chemical company has made headlines several times. Goldman Sachs raises its price target to 48 euros, while BASF itself is working to buy back its own shares and announce strategic agreements. The stock has been moving for weeks in a narrow range, approximately between 42 and 46 euros. But that’s exactly where something crucial could be brewing. The 50-day average is approaching the 200-day average from below – both are currently almost at the same level, around 43.57 and 43.80 euros respectively. If the shortest average exceeds the longest average, a so-called golden cross is created. This technical signal could be the starting signal for a rally towards 60 to 70 euros. However, if the breakout fails, there is a risk of falling back below 40 euros. The coming weeks will show whether BASF will turn the situation around or continue its consolidation.

Strategic decisions ensure movement

BASF cleans house and sets clear priorities. The sale of the optical brighteners business to Catexel has been finalized. At the same time, the group is massively strengthening its agricultural activity. The Nunhems subsidiary takes over Noble Seeds in India and thus strengthens its leading position in the field of vegetable seeds. Harbor Energy’s participation is particularly spicy. He bought the American producer LLOG Exploration for $3.2 billion. BASF owns 41 percent of Harbor Energy and thus benefits indirectly from increased cash flows from oil and gas activities in the Gulf of Mexico. The transaction is expected to be completed in the first quarter of 2026. Good news is also coming at the main plant in Ludwigshafen. A new agreement with the works council excludes layoffs for operational reasons until the end of 2028. At least 1.5 billion euros are spent each year on infrastructure and transformation. Management is also consistently pursuing its share buyback program. This continued demand stabilizes the price and signals confidence.

Charttechnik

The stock has been stuck in a relatively tight trading range since October. Basically, as already mentioned above, between 42 and 46 euros. It is precisely in this area that the decisive drama is currently taking place. The 50 SMA at 43.57 euros and the 200 SMA at 43.80 euros are quite close to each other. This rare constellation shows a close balance between buyers and sellers, but it could become explosive. The situation is interesting because if the shortest average exceeds the longest average, a golden cross is created. This bullish signal could trigger a strong upward movement. Analysts then see a potential of up to 60 or even 70 euros. However, if the bullish breakout fails, the situation becomes bleak. A return below 41.50 euros would technically open the door to the bottom. The 52-week low was 37.80 euros – this level could then quickly return to the center of attention. The current price of around 43.60 euros marks exactly a turning point. If you want to actively trade the range, you can place buy orders at the lower limit and sell orders at the upper limit. This way you are prepared for both scenarios.

What to do?

Goldman Sachs estimates that the stock will reach 48 euros and justifies this by improving cash flow and disciplined capital allocation. The ECB expects stronger growth of 1.2% in the Eurozone for 2026. This could finally provide a tailwind for the chemical industry. Basically, BASF does a lot of things right. The portfolio is adjusted, the agricultural division is strengthened and additional income comes from Harbor Energy. The dividend, which should amount to just over 2 euros, offers an attractive yield at the current price. Graphically, BASF finds itself at a crossroads. The possible Golden Cross would be a strong buy signal. If the breakout above 46 euros is successful, 60 to 70 euros is completely realistic. However, if action fails at this level, there is a risk of problems. For courageous and persistent investors, BASF is now worth the detour. Anyone who joins must set a stop price, e.g. B. set at 36.50 euros. The coming weeks will decide whether this sideways movement turns into a true trend reversal. The chances are not bad, but patience is required.

Author: Felix Goldbach, editorial team of FinanzNachrichten

Disclaimer/Disclaimer

The articles offered here are for informational purposes only and do not represent recommendations to buy or sell. They should not be understood either explicitly or implicitly as a guarantee of a specific price development of the financial instruments mentioned or as a call to action. The acquisition of securities involves risks which may lead to the total loss of the invested capital and – depending on the type of investment – even to additional obligations, such as additional contributions. This information is not a substitute for expert investment advice tailored to individual needs. Liability or guarantee for the topicality, correctness, relevance and completeness of the information provided as well as for financial losses is neither expressly nor implicitly assumed. Finanznachrichten.de has no influence on the published content. Finanznachrichten.de has no knowledge of the content or subject matter of the articles until they are published. Publications are produced by external authors or data providers. Accordingly, the content of the articles cannot be determined by the investment interests of Finanznachrichten.de and/or its employees or organizations.

Source link

#Trend #reversal #big #breakthrough #imminent

News & Knowledge / Facts

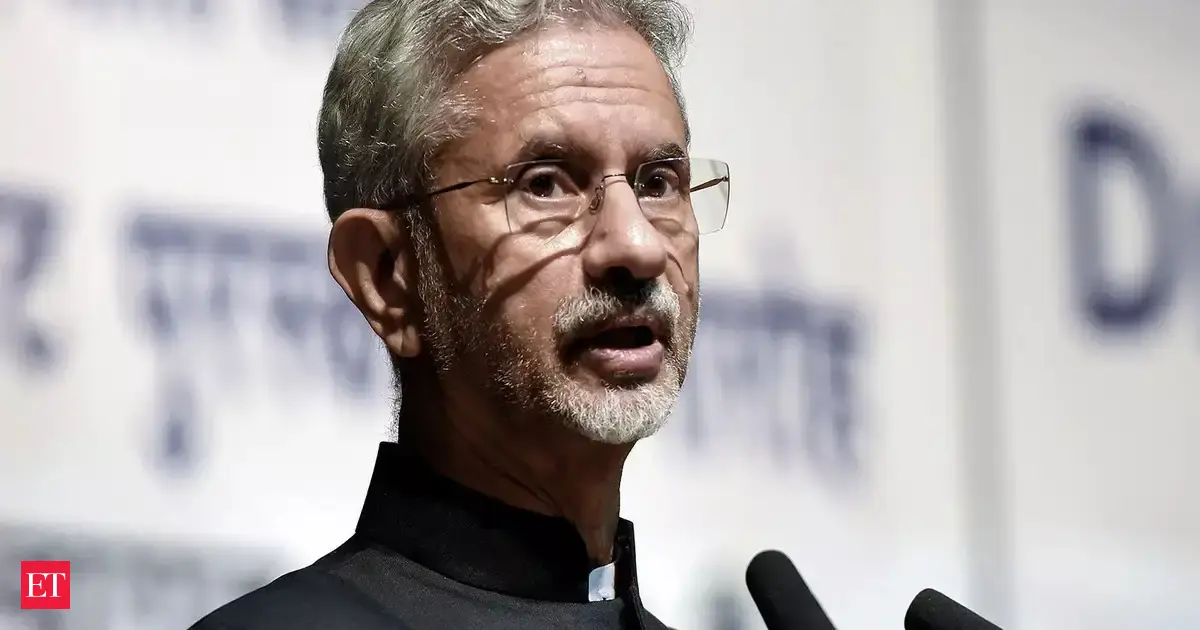

EAM S. Jaishankar to attend ex-Bangladesh PM Khaleda Zia’s fund in Dhaka tomorrow #EAM #Jaishankar #attend #exBangladesh #Khaleda #Zias #fund #Dhaka #tomorrow

“Foreign Minister Dr. S. Jaishankar will represent the Government and people of India at the funeral of Begum Khaleda Zia, former Prime Minister of Bangladesh and President of the Bangladesh Nationalist Party. He will therefore visit Dhaka on December 31, 2025,” the statement said.

Begum Khaleda Zia died today early morning at the age of 80, while undergoing treatment at Evercare Hospital in Dhaka.

According to a BNP statement on Facebook, Zia died around 6 a.m. (local time), shortly after the Fajr prayer. “Khaleda Zia died around 6 a.m., just after Fajr prayers,” the BNP statement said.

“We pray for the eternal peace of his soul and ask everyone to pray for his departed soul,” the text adds.

Zia was admitted to Evercare Hospital in the capital Dhaka on November 23 for a lung infection. The former prime minister has long suffered from various physical illnesses, including heart disease, diabetes, arthritis, liver cirrhosis and kidney complications, and earlier this month she was sent to London for advanced medical treatment for her illnesses.

Earlier, Prime Minister Narendra Modi expressed deep sadness over the demise of former Bangladesh Prime Minister and BNP Chairman, extending condolences to his family and the people of Bangladesh. In an article on

“Deeply saddened to learn of the death of former Prime Minister and BNP President Begum Khaleda Zia in Dhaka. Our deepest condolences to her family and all the people of Bangladesh. May the Almighty grant her family the fortitude to bear this tragic loss,” the Prime Minister said.

World leaders on Tuesday continued to express their condolences over the death of former Bangladesh Prime Minister and BNP chairwoman Begum Khaleda Zia, remembering her as a prominent democratic leader in her country.

Nepal’s Acting Prime Minister Sushila Karki said she was “deeply saddened” by the death of Khaleda Zia and offered condolences, on behalf of the government and people of Nepal, to her family and the people of Bangladesh.

“Begum Zia leaves behind a lifelong legacy of public service, with her enduring leadership marking a historic chapter in her country’s democratic journey,” Karki said in an article on

Source link

#EAM #Jaishankar #attend #exBangladesh #Khaleda #Zias #fund #Dhaka #tomorrow

News & Knowledge / Facts

Legacy of Leadership: Khaleda Zia’s Role in Bangladesh’s Democracy #Legacy #Leadership #Khaleda #Zias #Role #Bangladeshs #Democracy

Khaleda Zia, a dominant figure in Bangladesh’s political landscape, played a pivotal role in the restoration of democracy after military rule. As the country’s first female prime minister, she played a crucial role in unifying the Bangladesh Nationalist Party (BNP) during turbulent times.

Despite significant contributions, Zia’s tenure was marked by complex relations between India and Bangladesh. Allegations of support for Northeast insurgents strained ties, particularly during his second term, when alliances with Jamaat-e-Islami drew criticism from India on security grounds.

Zia’s legacy is highlighted by his leadership in the peaceful transition from dictatorship. However, his passing leaves the BNP at a crossroads, with his son Tarique Rahman set to lead the party amid ongoing electoral challenges.

(With input from agencies.)

Source link

#Legacy #Leadership #Khaleda #Zias #Role #Bangladeshs #Democracy

News & Knowledge / Facts

MARKETS EUROPE/DAX is up slightly at target level #MARKETS #EUROPEDAX #slightly #target #level

DJ MARKETS EUROPA/DAX is up slightly from the target level

DOW JONES–European stock markets are higher Tuesday afternoon. There is little news and most investors are no longer active as the start of the year approaches. We cannot exclude the so-called “window dressing” of individual stocks, i.e. the targeted maintenance of prices in the portfolios of institutional investors. On some exchanges, trading is shortened only on Tuesdays. Trading in Germany and Austria ends at 2 p.m. THIS. While today is the last trading day of the year on some exchanges, shortened listings will take place on Wednesday in Lisbon, London, Madrid and Paris.

The DAX gained 0.5 percent to 24,476 points; the index is up 22 percent since the start of the year. The DAX can look back on an excellent year overall. “A closer look, however, shows that only the first half of the year was excellent for the DAX. The second half of the year was more of a sideways trend,” explains QC Partners. The MDAX is once again lagging and is up 19 percent year to date. The TecDAX has a meager yield of 5 percent. This continues the pattern of German blue-chip companies performing better in their international operations than German mid-sized companies. Whether this will change with Germany’s billion-dollar investment program remains to be seen.

The Euro-Stoxx-50 rose by 0.6 percent to 5,789 points. The majority of the year’s best-performing countries come from the South, where European economic growth was based last year. The Spanish stock market rose by 48 percent, while in Athens the index even rose by 50 percent.

On the foreign exchange market, the euro changes little, at $1.1769; During the year, the greenback lost a lot of value. This is unlikely to make it easier for European companies to sell more expensive products around the world due to the strength of the euro next year. Yields on the bond markets are up slightly. After the liquidation of the day before, precious metals are recovering. The price of gold rose 1.2 percent to $4,385, silver rose 3.8 percent to $74.90. Not surprisingly, European mining stocks were one of the day’s winners, rising 1.6 percent. Shares of silver producer Fresnillo rose 5.5 percent.

The geopolitical situation remains tense. US President Donald Trump has threatened Iran with a military strike if the country resumes its nuclear program. Meanwhile, Hamas was threatened with serious consequences if the terrorist organization did not lay down its arms. Finally, China is organizing one of the largest military exercises in recent years off the coast of Taiwan. This is likely a reaction to the recent announcement of US arms deliveries to the island nation.

Additionally, the United States recently carried out an attack on a port area in Venezuela where US President Trump said drugs were being loaded onto boats and smuggled across international waters, saying a “big explosion” had occurred. Oil prices are barely reacting to this news. Brent is up 0.4 percent.

Defense stocks are recovering after the selling pressures of the day before. There is still no sign of progress in peace or ceasefire negotiations in Ukraine. Rheinmetall gained 2.1 percent, Renk 2.5 percent and Hensoldt 0.9 percent.

Meanwhile, bank stocks continue to run. The sector can look forward to a good year in 2025 thanks to the rise in yields on the bond markets. Deutsche Bank gains 1.5 percent and Commerzbank 2.0 percent.

Chipmaker Infineon’s sales growth (+1.8%) is down, with only one sector seeing strong growth: semiconductors to power AI data centers. “We are seeing a strong increase in demand and many indicators suggest that this will continue in the coming years,” CEO Jochen Hanebeck told Handelsblatt. “We currently cannot deliver as much as customers order.”

=== INDEX zuletzt +/- % absolut +/- % YTD Euro-Stoxx-50 5.788,57 +0,6% 36,86 +17,4% Stoxx-50 4.918,84 +0,5% 25,52 +13,6% DAX 24.476,16 +0,5% 125,04 +22,3% MDAX 30.548,50 +0,3% 95,97 +18,4% TecDAX 3.613,61 +0,4% 13,79 +5,0% SDAX 17.094,60 +0,5% 78,05 +22,6% CAC 8.141,91 +0,4% 29,89 +9,8% SMI 13.259,65 +0,1% 19,06 +14,2% ATX 5.304,29 +1,1% 56,33 +43,2% DEVISEN zuletzt +/- % 0:00 Mo, 18:00 % YTD EUR/USD 1,1769 +0,0% 1,1767 1,1756 +13,7% EUR/JPY 183,56 -0,1% 183,67 183,59 +13,1% EUR/CHF 0,9286 -0,1% 0,9291 0,9287 -1,0% EUR/GBP 0,8715 -0,0% 0,8716 0,8712 +5,4% USD/JPY 155,94 -0,1% 156,03 156,12 -0,5% GBP/USD 1,3505 +0,0% 1,3502 1,3494 +7,9% USD/CNY 7,0292 -0,0% 7,0312 7,0324 -2,3% USD/CNH 6,9881 -0,2% 6,9987 7,0001 -4,5% AUS/USD 0,6701 +0,1% 0,6693 0,6690 +8,4% Bitcoin/USD 87.770,40 +0,6% 87.232,35 87.544,55 -7,3% ROHÖL zuletzt VT-Settlem. +/- % +/- USD % YTD WTI/Nymex 58,29 58,08 +0,4% 0,21 -20,9% Brent/ICE 62,12 61,94 +0,3% 0,18 -19,4% METALLE zuletzt Vortag +/- % +/- USD % YTD Gold 4.384,52 4.330,40 +1,2% 54,12 +72,8% Silber 74,90 72,18 +3,8% 2,73 +173,6% Platin 1.854,76 1.791,70 +3,5% 63,06 +137,7% Kupfer 5,49 5,49 0% 0,00 +33,6% YTD bezogen auf Schlussstand des Vortags (Angaben ohne Gewähr) ===

Contact the author: maerkte.de@dowjones.com

DJG/thl/ros

(END) Dow Jones Newswires

December 30, 2025 7:01 a.m. ET (12:01 p.m. GMT)

Copyright (c) 2025 Dow Jones & Company, Inc.

Source link

#MARKETS #EUROPEDAX #slightly #target #level

-

News & Knowledge / Facts2 days ago

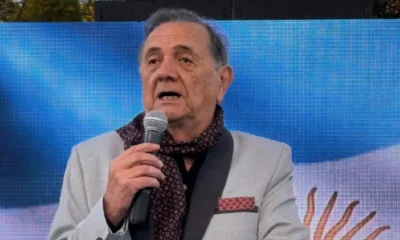

News & Knowledge / Facts2 days agoTango is sad: singer “Chiqui” Pereyra has died #Tango #sad #singer #Chiqui #Pereyra #died

-

News & Knowledge / Facts3 days ago

News & Knowledge / Facts3 days agoRayan Cherki scores crucial late victory for Manchester City at Nottingham Forest #Rayan #Cherki #scores #crucial #late #victory #Manchester #City #Nottingham #Forest

-

Ireland2 days ago

Ireland2 days agoRIP: Christmas tragedy as two elderly men die following fire at rural Sligo house #RIP #Christmas #tragedy #elderly #men #die #fire #rural #Sligo #house

-

Ireland4 days ago

Ireland4 days agoRaw revelations from within the royal family in the 1995 State Papers #Raw #revelations #royal #family #State #Papers

-

News & Knowledge / Facts3 days ago

News & Knowledge / Facts3 days agoRussian drones and missiles bomb Ukraine ahead of Zelensky-Trump meeting #Russian #drones #missiles #bomb #Ukraine #ahead #ZelenskyTrump #meeting

-

News & Knowledge / Facts4 days ago

News & Knowledge / Facts4 days agoCAN: Salah’s penalty sinks South Africa #Salahs #penalty #sinks #South #Africa

-

News & Knowledge / Facts3 days ago

News & Knowledge / Facts3 days agoRussia targets kyiv with missiles ahead of Ukraine-US meeting #Russia #targets #kyiv #missiles #ahead #UkraineUS #meeting

-

Ireland3 days ago

Ireland3 days agoJohn Major ‘yelled at’ by Irish justice minister in Troubles-era meeting #John #Major #yelled #Irish #justice #minister #Troublesera #meeting